Today’s consumers have a lot of power. As a business, you must have a deep understanding of who your buyers are and what influences their purchase decisions.

Enter: Market Research.

Whether you’re new to market research or not, I created this guide to help you conduct a thorough study of your market, target audience, competition, and more. Let’s dive in.

Table of Contents

What is market research?

Market research is the process of gathering information about your target market and customers to verify the success of a new product, help your team iterate on an existing product, or understand brand perception to ensure your team is effectively communicating your company’s value effectively.

Market research can answer various questions about the state of an industry. But if you ask me, it’s hardly a crystal ball that marketers can rely on for insights on their customers.

Market researchers investigate several areas of the market, and it can take weeks or even months to paint an accurate picture of the business landscape.

However, researching just one of those areas can make you more intuitive to who your buyers are and how to deliver value that no other business is offering them right now.

How? Consider these two things:

- Your competitors also have experienced individuals in the industry and a customer base. It‘s very possible that your immediate resources are, in many ways, equal to those of your competition’s immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your customers don’t represent the attitudes of an entire market. They represent the attitudes of the part of the market that is already drawn to your brand.

The market research services market is growing rapidly, which signifies a strong interest in market research as we enter 2024. The market is expected to grow from roughly $75 billion in 2021 to $90.79 billion in 2025.

Why do market research?

Market research allows you to meet your buyer where they are.

As our world becomes louder and demands more of our attention, this proves invaluable.

By understanding your buyer’s problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into the following:

- Where your target audience and current customers conduct their product or service research

- Which of your competitors your target audience looks to for information, options, or purchases

- What’s trending in your industry and in the eyes of your buyer

- Who makes up your market and what their challenges are

- What influences purchases and conversions among your target audience

- Consumer attitudes about a particular topic, pain, product, or brand

- Whether there‘s demand for the business initiatives you’re investing in

- Unaddressed or underserved customer needs that can be flipped into selling opportunity

- Attitudes about pricing for a particular product or service

Ultimately, market research allows you to get information from a larger sample size of your target audience, eliminating bias and assumptions so that you can get to the heart of consumer attitudes.

As a result, you can make better business decisions.

Primary vs. Secondary Research

To give you an idea of how extensive market research can get, consider that it can either be qualitative or quantitative in nature — depending on the studies you conduct and what you’re trying to learn about your industry.

Qualitative research is concerned with public opinion, and explores how the market feels about the products currently available in that market.

Quantitative research is concerned with data, and looks for relevant trends in the information that’s gathered from public records.

That said, there are two main types of market research that your business can conduct to collect actionable information on your products: primary research and secondary research.

Primary Research

Primary research is the pursuit of first-hand information about your market and the customers within your market.

It’s useful when segmenting your market and establishing your buyer personas.

Primary market research tends to fall into one of two buckets:

- Exploratory Primary Research: This kind of primary market research normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.

- Specific Primary Research: This type of research often follows exploratory research. In specific research, you take a smaller or more precise segment of your audience and ask questions aimed at solving a suspected problem.

Secondary Research

Secondary research is all the data and public records you have at your disposal to draw conclusions from (e.g. trend reports, market statistics, industry content, and sales data you already have on your business).

Secondary research is particularly useful for analyzing your competitors. The main buckets your secondary market research will fall into include:

- Public Sources: These sources are your first and most-accessible layer of material when conducting secondary market research. They’re often free to find and review — like government statistics (e.g., from the U.S. Census Bureau).

- Commercial Sources: These sources often come in the form of pay-to-access market reports, consisting of industry insight compiled by a research agency like Pew, Gartner, or Forrester.

- Internal Sources: This is the market data your organization already has like average revenue per sale, customer retention rates, and other historical data that can help you draw conclusions on buyer needs.

Types of Market Research

- Interviews

- Focus Groups

- Product/ Service Use Research

- Observation-Based Research

- Buyer Persona Research

- Market Segmentation Research

- Pricing Research

- Competitive Analysis Research

- Customer Satisfaction and Loyalty Research

- Brand Awareness Research

- Campaign Research

1. Interviews

Interviews allow for face-to-face discussions so you can allow for a natural flow of conversation. Your interviewees can answer questions about themselves to help you design your buyer personas and shape your entire marketing strategy.

2. Focus Groups

Focus groups provide you with a handful of carefully-selected people that can test out your product and provide feedback. This type of market research can give you ideas for product differentiation.

3. Product/Service Use Research

Product or service use research offers insight into how and why your audience uses your product or service. This type of market research also gives you an idea of the product or service’s usability for your target audience.

4. Observation-Based Research

Observation-based research allows you to sit back and watch the ways in which your target audience members go about using your product or service, what works well in terms of UX, and which aspects of it could be improved.

5. Buyer Persona Research

Buyer persona research gives you a realistic look at who makes up your target audience, what their challenges are, why they want your product or service, and what they need from your business or brand.

6. Market Segmentation Research

Market segmentation research allows you to categorize your target audience into different groups (or segments) based on specific and defining characteristics. This way, you can determine effective ways to meet their needs.

7. Pricing Research

Pricing research helps you define your pricing strategy. It gives you an idea of what similar products or services in your market sell for and what your target audience is willing to pay.

8. Competitive Analysis

Competitive analyses give you a deep understanding of the competition in your market and industry. You can learn about what’s doing well in your industry and how you can separate yourself from the competition.

9. Customer Satisfaction and Loyalty Research

Customer satisfaction and loyalty research gives you a look into how you can get current customers to return for more business and what will motivate them to do so (e.g., loyalty programs, rewards, remarkable customer service).

10. Brand Awareness Research

Brand awareness research tells you what your target audience knows about and recognizes from your brand. It tells you about the associations people make when they think about your business.

11. Campaign Research

Campaign research entails looking into your past campaigns and analyzing their success among your target audience and current customers. The goal is to use these learnings to inform future campaigns.

How to Do Market Research

- Define your buyer persona.

- Identify a persona group to engage.

- Prepare research questions for your market research participants.

- List your primary competitors.

- Summarize your findings.

1. Define your buyer persona.

You have to understand who your customers are and how customers in your industry make buying decisions.

This is where your buyer personas come in handy. Buyer personas — sometimes referred to as marketing personas — are fictional, generalized representations of your ideal customers.

Some key characteristics you should be keen on including in your buyer persona are:

- Age

- Gender

- Location

- Job title(s)

- Job titles

- Family size

- Income

- Major challenges

The idea is to use your persona(s) as a guideline for how to effectively reach and learn about the real audience members in your industry.

To get started with creating your personas, check out these free templates, as well as this helpful tool.

2. Identify a persona group to engage.

Now that you know who your buyer personas are, use that information to help you identify a group to engage to conduct your market research with.

This should be a representative sample of your target customers so you can better understand their actual characteristics, challenges, and buying habits.

How to Identify the Right People to Engage for Market Research

When choosing who to engage for your market research, you should:

- Aim for 10 participants per buyer persona. I recommend focusing on one persona at a time.

- Select people who have recently interacted with you. Focus on behaviors within the past six months (or up to a year).

- Gather a mix of participants. Recruit people who have purchased your product, purchased a competitor’s product, and decided not to purchase anything at all.

- Provide an incentive. Motivate someone to spend 30-45 minutes on you and your study. On a tight budget? You can reward participants for free by giving them exclusive access to content.

3. Prepare research questions for your market research participants.

The best way to make sure you get the most out of your conversations is to be prepared.

You should always create a discussion guide to make sure you use your time wisely. Your discussion guide should be in an outline format, with a time allotment and open-ended questions for each section.

Wait, all open-ended questions?

Yes — this is a golden rule of market research. You never want to “lead the witness” by asking yes and no questions, as that puts you at risk of unintentionally swaying their thoughts by leading with your own hypothesis.

Asking open-ended questions also helps you avoid one-word answers (which aren’t very helpful for you).

Example Outline of a 30-Minute Survey

Here’s a general outline for a 30-minute survey for one B2B buyer.

Want to make it a digital survey? Use HubSpot’s free online form builder.

Background Information (5 minutes)

Ask the buyer to give you a little background information (their title, how long they’ve been with the company, and so on). Then, ask a fun/easy question to warm things up (first concert attended, favorite restaurant in town, etc.).

Here are some key background questions to ask your target audience:

- Describe how your team is structured.

- Tell me about your personal job responsibilities.

- What are the team’s goals and how do you measure them?

- What has been your biggest challenge in the past year?

Now, make a transition to acknowledge the specific purchase or interaction they made that led to you including them in the study. The next three stages of the buyer’s journey will focus specifically on that purchase.

Awareness (5 minutes)

Here, you want to understand how they first realized they had a problem that needed to be solved without getting into whether or not they knew about your brand yet.

- Think back to when you first realized you needed a [name the product/service category, but not yours specifically]. What challenges were you facing at the time?

- How did you know that something in this category could help you?

- How familiar were you with different options on the market?

Consideration (10 minutes)

Now you want to get very specific about how and where the buyer researched potential solutions. Plan to interject to ask for more details.

- What was the first thing you did to research potential solutions? How helpful was this source?

- Where did you go to find more information?

If they don’t come up organically, ask about search engines, websites visited, people consulted, and so on. Probe, as appropriate, with some of the following questions:

- How did you find that source?

- How did you use vendor websites?

- What words specifically did you search on Google?

- How helpful was it? How could it be better?

- Who provided the most (and least) helpful information? What did that look like?

- Tell me about your experiences with the sales people from each vendor.

Decision (10 minutes)

- Which of the sources you described above was the most influential in driving your decision?

- What, if any, criteria did you establish to compare the alternatives?

- What vendors made it to the short list and what were the pros/cons of each?

- Who else was involved in the final decision? What role did each of these people play?

- What factors ultimately influenced your final purchasing decision?

Closing

Here, you want to wrap up and understand what could have been better for the buyer.

- Ask them what their ideal buying process would look like. How would it differ from what they experienced?

- Allow time for further questions on their end.

- Don’t forget to thank them for their time and confirm their address to send a thank-you note or incentive.

4. List your primary competitors.

List your primary competitors — keep in mind listing the competition isn’t always as simple as Company X versus Company Y.

Sometimes, a division of a company might compete with your main product or service, even though that company’s brand might put more effort in another area.

For example, Apple is known for its laptops and mobile devices but Apple Music competes with Spotify over its music streaming service.

From a content standpoint, you might compete with a blog, YouTube channel, or similar publication for inbound website visitors — even though their products don’t overlap with yours at all.

For example, a toothpaste company might compete with magazines like Health.com or Prevention on certain blog topics related to health and hygiene even though the magazines don’t actually sell oral care products.

Identifying Industry Competitors

To identify competitors whose products or services overlap with yours, determine which industry or industries you’re pursuing.

Start high-level, using terms like education, construction, media & entertainment, food service, healthcare, retail, financial services, telecommunications, and agriculture.

You can build your list the following ways:

- Review your industry quadrant on G2 Crowd. G2 Crowd aggregates user ratings and social data to create “quadrants,” where you can see companies plotted as contenders, leaders, niche, and high performers in their respective industries.

- Download a market report. Companies like Forrester and Gartner offer both free and gated market forecasts every year on the vendors who are leading their industry.

- Search using social media. Social networks make great company directories. On LinkedIn, for example, select the search bar and enter the name of the industry you’re pursuing. Then, under “More,” select “Companies” to narrow your results.

Identifying Content Competitors

Search engines are your best friends in this area of secondary market research.

To find the online publications with which you compete, take the overarching industry term you identified in the section above, and come up with a handful of more specific industry terms your company identifies with.

A catering business, for example, might generally be a “food service” company, but also consider itself a vendor in “event catering,” “cake catering,” or “baked goods.” Once you have this list, do the following:

- Google it. Don’t underestimate the value in seeing which websites come up when you run a search on Google for the industry terms that describe your company. You might find a mix of product developers, blogs, magazines, and more.

- Compare your search results against your buyer persona. If the content the website publishes seems like the stuff your buyer persona would want to see, it’s a potential competitor, and should be added to your list of competitors.

5. Summarize your findings.

Feeling overwhelmed by the notes you took? We suggest looking for common themes that will help you tell a story and create a list of action items.

To make the process easier, try using your favorite presentation software to make a report, as it will make it easy to add in quotes, diagrams, or call clips.

Feel free to add your own flair, but the following outline should help you craft a clear summary:

- Background: Your goals and why you conducted this study.

- Participants: Who you talked to. A table works well so you can break groups down by persona and customer/prospect.

- Executive Summary: What were the most interesting things you learned? What do you plan to do about it?

- Awareness: Describe the common triggers that lead someone to enter into an evaluation. (Quotes can be very powerful.)

- Consideration: Provide the main themes you uncovered, as well as the detailed sources buyers use when conducting their evaluation.

- Decision: Paint the picture of how a decision is really made by including the people at the center of influence and any product features or information that can make or break a deal.

- Action Plan: Your analysis probably uncovered a few campaigns you can run to get your brand in front of buyers earlier and/or more effectively. Provide your list of priorities, a timeline, and the impact it will have on your business.

Market Research Report Template

Within a market research kit, there are a number of critical pieces of information for your business‘s success. Let’s take a look at these elements.

Pro Tip: Upon downloading HubSpot’s free Market Research Kit, you’ll receive editable templates for each of the given parts of the kit, instructions on how to use the kit, and a mock presentation that you can edit and customize.

Download HubSpot’s free, editable market research report template here.

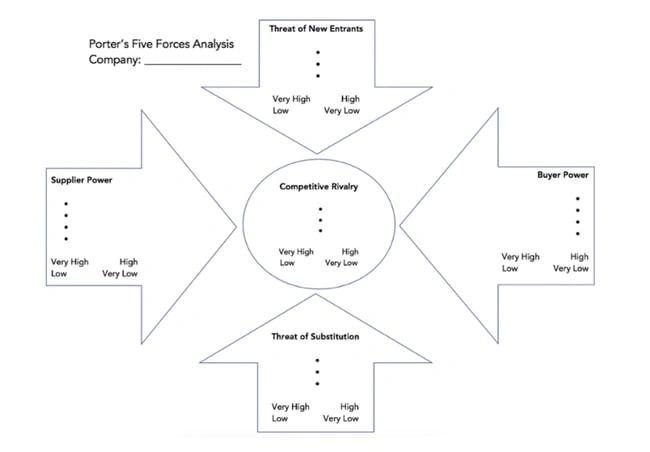

1. Five Forces Analysis Template

Use Porter’s Five Forces Model to understand an industry by analyzing five different criteria and how high the power, threat, or rivalry in each area is — here are the five criteria:

- Competitive rivalry

- Threat of new entrants

- Threat of substitution

- Buyer power

- Supplier power

Download a free, editable Five Forces Analysis template here.

2. SWOT Analysis Template

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis looks at your internal strengths and weaknesses, and your external opportunities and threats within the market.

A SWOT analysis highlights direct areas of opportunity your company can continue, build, focus on, and work to overcome.

Download a free, editable SWOT Analysis template here.

3. Market Survey Template

Market surveys help you uncover important information about your buyer personas, target audience, current customers, market, and competition.

Surveys should contain a variety of question types, like multiple choice, rankings, and open-ended responses.

Here are some categories of questions you should ask via survey:

- Demographic questions

- Business questions

- Competitor questions

- Industry questions

- Brand questions

- Product questions

Download a free, editable Market Survey template here.

4. Focus Group Template

Focus groups are an opportunity to collect in-depth, qualitative data from your real customers or members of your target audience.

You should ask your focus group participants open-ended questions. While doing so, keep these tips top of mind:

- Set a limit for the number of questions you‘re asking (after all, they’re open-ended).

- Provide participants with a prototype or demonstration.

- Ask participants how they feel about your price.

- Ask participants about your competition.

- Offer participants time at the end of the session for final comments, questions, or concerns.

Download a free, editable Focus Group template here.

Market Research Examples

1. TikTok uses in-app research surveys to better understand consumer viewing preferences and ad experiences.

If you’re a TikTok enthusiast (like me), then you’ve probably been served a survey or two while you scroll through your For You feed.

TikTok has strategically started using in-app market research surveys to help improve the viewer experiences.

I’ve received two different types of surveys so far.

The first type typically follows a video or an ad and asks how I felt about the video I just viewed. There are options like “I don’t like this ad,” “I enjoyed watching this video,” or “This content is appropriate.”

The other type of survey I’ve gotten asks if I’ve recently seen a sponsored video or ad from a particular brand. For example, “Did you see any promotional content from the Dove Self Esteem Project in the past two days on TikTok?

TikTok can then use this information to tweak my algorithm to match my preferences or to serve ads that are more in line with my buying behaviors.

2. Taco Bell tests new products in select markets before launching nationwide.

Taco Bell is known for their innovative, consumer-driven menu items. In fact, just last year, they gave Taco Bell rewards members exclusive access to vote on the newest round of hot sauce sayings.

This popular fast-food chain puts a lot of menu decisions in the hands of their target market. Taco Bell lovers ultimately determine which new menu items stay on the menu through voting and, ultimately, their purchase behaviors.

(Let’s all collectively agree that the Cheez-It Crunchwrap deserves a permanent spot.)

Often, this process of releasing a new item is done regionally before a nationwide launch. This is a form of market research — soft launching products in smaller markets to determine how well it sells before dedicating too many resources to it.

The way Taco Bell uses this information is pretty straightforward. If the product is not successful, it’s unlikely to be released on a national scale.

3. The Body Shop used social listening to determine how they should reposition brand campaigns to respond to what their customers cared most about.

The Body Shop has long been known for offering ethically sourced and natural products, and proudly touts “sustainability” as a core value.

To dive deeper into the sustainability subtopics that meant the most to their audiences, the team at The Body Shop tracked conversations and ultimately found their audiences cared a lot about refills.

Using this information helped the Body Shop team feel confident when relaunching their Refill Program across 400 stores globally in 2022.

Market research proved they were on the right track with their refill concept, and demonstrated increased efforts were needed to show Body Shop customers that the Body Shop cared about their customers’ values.

Conduct Market Research to Grow Better

Conducting market research can be a very eye-opening experience. Even if you think you know your buyers pretty well, completing the study will likely uncover new channels and messaging tips to help improve your interactions.

Editor’s note: This post was originally published in March 2016 and has been updated for comprehensiveness.